Restoring our Earth starts with water.

By Laney Beaman, Investor Relations Manager at WaterEquity

Today is Earth Day and celebration is in order — but if I’m being honest, I celebrate with mixed feelings. I’ve always carried a deep admiration for Mother Earth, and yet, I am filled with angst and urgency around the lack of action to protect our only home. The fact remains we are not on track to lower our carbon emissions to stay under the threshold of 2 degrees Celsius or achieve the United Nations Sustainable Development Goals (SDGs) by 2030. At bare minimum, these facts are daunting. A large part of this failure can be attributed to a lack of investment in climate action — including the water and sanitation sector — from the private capital markets. Beholden to the status quo, the wealth management industry is just beginning to pivot to include social impact alongside financial returns. Why the change in strategy you may ask? With the largest wealth transfer in economic history underway, the millennial generation is more concerned with positive social outcomes than making a healthy return, and private markets are playing catchup to offer adequate options to this drastically different clientele.

Here at WaterEquity, we are correcting this market failure by providing investors viable options in the water and sanitation sector. Our mission is to solve for SDG 6–access to safe water and sanitation for all. And so, this is where hope creeps in and level-sets the worry, because there is not only tremendous opportunity to solve for the water and climate crisis that so many people around the world face, but simultaneously create more sustainable systems that contribute to a healthier planet.

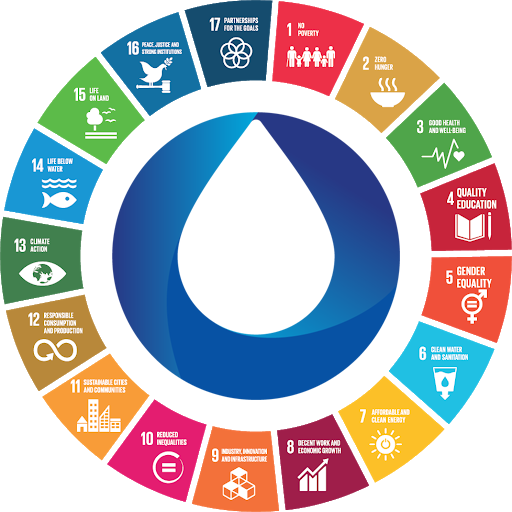

As an impact investment manager, WaterEquity raises funds and then deploys that capital to financial institutions and enterprises expanding water and sanitation services to low-income communities. In the case of investing in enterprises this can include water service providers, infrastructure systems, or fecal sludge management. For financial institutions, our investment is used to offer small, affordable loans to low-income consumers to install a piped water connection, toilet, or both within the household. Whatever the solution purchased, the choice is the clients — more often a woman than not — and that choice can be empowering and life changing. When you look at solving for universal access to water and sanitation, you recognize that water underscores each of the other 17 SDGs — from health, to education, to peace and justice, to name a few. Water is the powerhouse of our planet and a natural change agent. Restoring our Earth starts with water.

Let’s pause to define what we mean when we talk about the water and climate crisis: 1 in 3 people lack access to proper sanitation and 1 in 9 lack access to a safe water source. This leads to environmental challenges that quickly add up. To name just a few:

- In the context of open defecation, discharge of untreated waste negatively impacts water quality by damaging aquatic ecosystems and contaminating drinking water supplies.

- Typical water and sanitation infrastructure, which is antiquated and inefficient, requires high levels of energy use for pumping and wastewater treatment, incurs significant water loss through leaky pipes, and is a contributor to greenhouse gas emissions.

- Water scarcity — “By 2050, 40% of the world’s population is projected to live under severe water stress due to climate change and increased urbanization.” The OECD Environmental Outlook to 2050 (2012).

Squaring up to these challenges presents obvious solutions:

- By offering communities the opportunity to take out a small loan to install a toilet or investing in sewage and fecal sludge management, WaterEquity’s funds increase the number of families living in poverty with safely managed sanitation, reducing water pollution and increasing water quality.

- By investing in energy efficient water and sanitation infrastructure that increases resource recovery, WaterEquity’s funds help build more sustainable infrastructure that reduces greenhouse gas emissions.

- WaterEquity’s funds invest in solutions to address water scarcity, including better management of existing resources — reducing waste and reusing wastewater — or developing new infrastructure.

In just under five years, WaterEquity has reached 1.8 million people with access to safe water or sanitation, and we are scaling our reach over the next few years to impact an additional 5 million people. By 2028, across our current funds, we expect to have ended this crisis for 11 million people through more than $200 million in investments into the water and sanitation sector.

With the demand to see positive social and environmental impact as a direct outcome of investment, coupled with a multi-trillion wealth transfer, capital markets can affect tremendous, positive change on a global level. And so I’m reminded there are many reasons to celebrate this Earth Day, knowing that day by day the most basic of human rights is being extended to those who bear the greatest burden of global crises, and that development within the climate action and water and sanitation sector is prioritizing planet and people over profit.

“If there is magic on this planet, it is contained in water” — Loren Eiseley, The Immense Journey (1957).

Laney Beaman is Investor Relations Manager at WaterEquity. She is responsible for strategic partner research and creates effective methods to increase efficiency across the Investor Relations team while supporting a portfolio of WaterEquity’s collaborative partnerships. Laney brings 10 years of experience in program development, partnership building, communications, and event management.